What is Auto-Fill my Return (AFR) and TDF?

Both the Auto-fill my return (AFR) and the Téléchargement des données fiscales (TDF) services allow you to securely download your information slips (such as your T4 or RL-1 slip) and other tax-related information from the Canada Revenue Agency (CRA) or Revenu Québec website into your tax return – saving you time and reducing data entry errors.

Important: You must register for these services before you can use them. Once registered, you'll need the following to use them:

For more information on each service, check out the sections below.

- To download your federal slips with AFR

- Your social insurance number (SIN)

- Your CRA My Account user ID and password

- The security code that the CRA sent you, if you’re only partially registered for the CRA My Account

- To download your RL slips with TDF

- Your social insurance number (SIN)

- Your date of birth

- The notice number from your 2019 or 2020 Revenu Québec notice of assessment

With the Canada Revenue Agency (CRA)’s Auto-fill my return (AFR) service you can automatically fill-in certain sections of your tax return like your information slips, tuition carryforward amounts on Schedule 11, RRSP contribution limit on Schedule 7, and more.

To use AFR, you must be registered for the CRA’s My Account service.

However, before you can register for CRA My Account, you must have filed at least one tax return with the CRA, so if this is the first time you’re filing a tax return, you won’t be able to use AFR. Check out our help article on how to register for CRA My Account.

After you’re registered for CRA My Account, follow these steps in H&R Block’s tax software to use AFR:

Important: On the Your personal information page under the ABOUT YOU on the GET STARTED tab, make sure you’ve entered your SIN correctly and answered Yes to the following question: Do you have a CRA My Account?

- Click the Auto-fill My Return button.

- On the Auto-fill my return page, click I Agree, Sign in to CRA My Account.

- The CRA’s Tax information web service page will open in a new window. To access AFR, you’ll need to log in to the service using a Sign-in Partner or your CRA user ID and password.

Note: Use the method you used when you registered for CRA My Account.

- Once you’re logged in, your tax information will be transferred to H&R Block’s tax software. The CRA window will close automatically once the transfer is complete and you’ll be taken back to your return in the tax software to review the downloaded information.

Note: If you use the AFR feature and discover that the CRA has nothing on file for you, it could be that you’re trying to download your information before the CRA has had a chance to collect it. It’s also possible you simply don’t have any slips or other information available for download. By waiting until the middle of March to download your slips, there’s a greater chance that all of your information will be available.

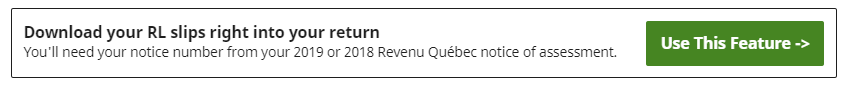

Like the CRA, Revenu Québec offers a similar service called Téléchargement des données fiscales (TDF) that allows residents of Québec to securely download their RL slips.

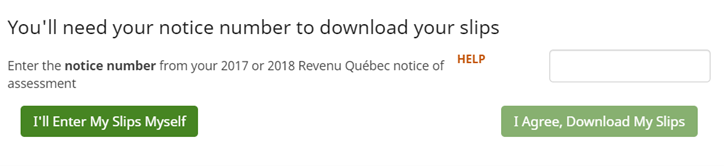

To use Revenu Québec’s TDF service, you'll need to make sure you've entered your SIN and date of birth on the Your personal information page under ABOUT YOU on the GET STARTED tab in H&R Block’s tax software. Then:

- Click the Use This Feature button.

Note: If you have a CRA My Account and want to use the AFR service to download your federal slips into your return, you’ll be given the option to do that here. Refer to the Auto-fill my return (CRA service) section above for more information.

- Enter your most recent Notice of Assessment (NOA) number* and click the I Agree, Download My Slips button to download your RL slips and other tax information into your return.

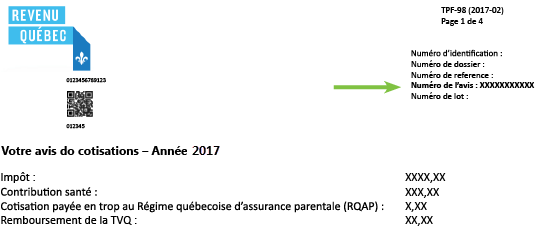

Tip: Your NOA number can be found in the top right corner of page 1 of your NOA:

Note: If you use the TDF service and discover Revenu Québec has nothing on file for you, it could be that you’re trying to download your information before Revenu Québec has had a chance to collect it. It’s also possible you simply don’t have any slips or other information available for download. By waiting until the middle of March to download your slips, there’s a greater chance that all of your information will be available.

Yes! Only you or a designated representative can access your personal tax information using the AFR service. Before you import your information into your return, you must first sign into your CRA My Account (which is itself protected by a number of security protocols). Once you’ve signed in, the import process will begin downloading your tax information directly into your return via a secured, encrypted connection.

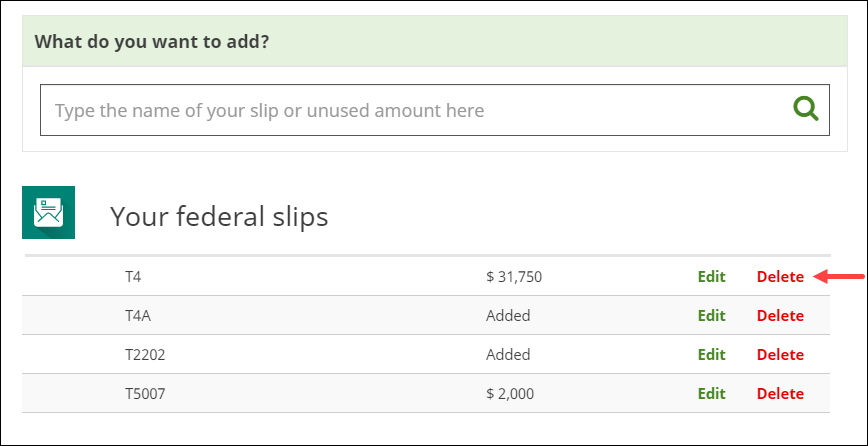

Once you’ve downloaded all of your slips and tax-related information from the appropriate agency, the next step is to enter any tax slips you received that weren’t available through the AFR or TDF services.

Items that you can search for include:

- Your federal slips (T4, T4A, T2202, etc.)

- Your Québec relevé slips (RL-1, RL-8, RL-24, etc.)

- Your RRSP contributions

- Your unused amounts (like tuition fees)

Once you’ve finished entering your slips, click the Continue button and head over to the PREPARE section of the tax software. There, you’ll be able to choose the different tax-related situations that apply to you and claim credits, deductions, and enter any receipt information you might have.

You might have downloaded the same slip more than once:

- By accident or

- If the issuer made an error on the original slip and had to re-issue it

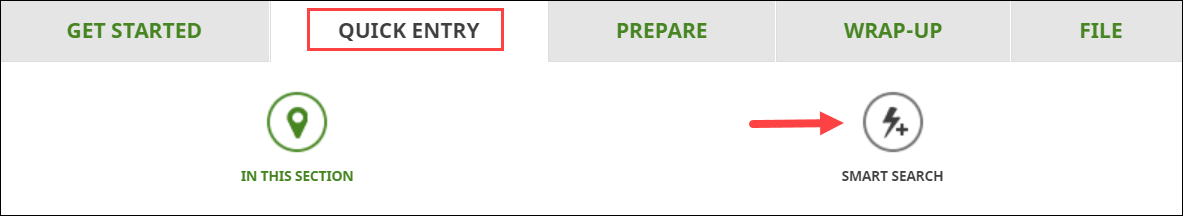

In either case, you’ll need to delete the duplicate or incorrect version of the slip. You can do this by clicking the Delete button next to the slip you’d like to remove from your return on the SMART SEARCH page.

The Canada Revenue Agency (CRA) keeps a track of certain amounts and information from year to year for you. Some of this information might download into your return when you use Auto-fill my return (AFR) even if the slip or information field is blank. Here are some scenarios when this might happen:

- Blank RRSP receipt – If you opened a registered retirement savings plan (RRSP) account with your bank or financial institution but didn’t make any RRSP contributions, your bank might issue a blank slip to you and the CRA confirming nothing was contributed to this plan.

- Zero unused RRSP contributions - The CRA tracks your RRSP deduction limit and unused RRSP contributions for each year (if you earn income, have a social insurance number, and have filed a tax return) even if you have never contributed to an RRSP account. If you downloaded a zero amount for your unused RRSP contributions, this is a confirmation that you don’t have any unused RRSP contributions from previous years.

- Capital gains or losses history – If you had investment income in a previous year, you might see your capital gains or losses history in your downloaded information even if you don’t need to claim the capital gains deduction this year. This is because the CRA keeps track of your capital gains and loss from year to year. If you see an amount for a capital loss in your capital gains or losses history, depending on the source of this amount, you can apply the loss to offset capital gains in a future year or to a return for the previous 3 years.

- Foreign property declared in 2020 – You will download the Owned or held specified foreign property with a cost of more than $100,000 CAD field which will be either a Yes or No depending on what you declared last year. If you declared foreign property with a cost of over $100,000 last year, and the situation still applies to you, you will need to complete the T1135 form again this year.

Note: Remember to double-check the information you downloaded using the CRA’s AFR service to make sure it is accurate. The CRA might not have all your slips and/or tax information on file.