Canada Training Credit

Starting with your 2020 tax return, a new refundable credit called the Canada training credit will be available if you paid eligible tuition and other fees for courses you took during the year.

You can claim the Canada training credit if:

-

You file a return for 2021

-

Your Canada training limit is more than zero

-

You are resident in Canada throughout the year

-

You paid tuition or fees to an eligible educational institution (a university, college, or other educational institution in Canada that provides courses at a post-secondary level or occupational-skills courses that are certified by the Minister of Employment and Social Development)

-

Your tuition or fees are eligible for the existing tuition tax credit

The amount you can claim for this credit will be the least of the following amounts:

-

Your Canada training credit limit for the taxation year or

-

Half of the eligible tuition and fees you paid to an eligible educational institution

You earn $250 towards your Canada training limit for each year you report income on your tax return, up to a lifetime maximum of $5,000. The first $250, which you can claim in 2020, is based on the income you reported on your 2019 return.

You started accumulating your Canada training limit, if on December 31, 2019 you were between 25 and 65 years old and you met the following conditions:

- you filed a tax return for the 2019 tax year

- you were resident in Canada throughout 2019

- you had a total of $10,000 or more in income from:

- maternity and parental benefits and

- working income (such as employment income, business income, taxable part of scholarship income etc.)

- Your individual net income for 2019 wasn’t more than the top of the third tax bracket ($147,667 for 2019).

Yes, but if your tuition tax credit will be reduced by the Canada training credit you claim in the year.

Starting in 2020, you can claim the Canada training credit at the same time as you claim your tuition tax credit (Schedule 11).

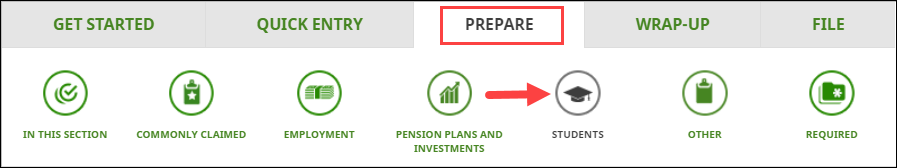

Follow these steps in H&R Block’s 2021 tax software to complete the federal Schedule 11 (and provincial Schedule 11 or Schedule T, if applicable):

- Under the PREPARE tab, click the IN THIS SECTION icon.

- In the Unused tuition amounts and student loans box, click the Add This Topic button.

- Click the STUDENTS icon. You'll find yourself here:

-

Under the CREDIT AMOUNTS heading, select the checkbox labelled Tuition or examination fees carried forward from a previous year (Schedule 11 & Schedule T), and then click Continue.

- When you arrive at Tuition or examination fees carried forward from a previous year page, enter your information into the tax software.