Canadian Journalism Labour Tax Credit

The refundable Canadian journalism labour tax credit is designed to help Canadian news providers pay for the salaries of their employees.

You might be able to claim this amount if you’re a qualified Canadian journalism organization (QCJO) and you meet the following conditions:

-

You publish written news rather than broadcasting it on television or the radio (some exceptions apply, for example, if you host a podcast); and

-

Your business meets the ownership conditions of a Canadian newspaper as defined in the Income Tax Act

If you aren’t one already, to become a QCJO, you must submit the Application for Qualified Canadian Journalism Organization Designation to the Canada Revenue Agency (CRA). The CRA will let you know if your organization qualifies as a QCJO.

As a QCJO, your readers might be able to claim the Digital news subscription tax credit for subscribing to your digital news content.

You can use this self-screening tool to find out if your organization is eligible to apply.

You can claim 25% of the salaries you paid to eligible newsroom employees during the year (up to $55,000 per eligible employee) less any assistance you received for these employees. This means you can receive up to $13,750 for each of your eligible newsroom employees!

The amount you can claim this year will be reported in box 236 of your T5013 slip.

Important: If you received financial support from the Aid to Publishers under the Canadian Periodical Fund, that amount will be subtracted from the Canadian journalism labour tax credit.

To be an eligible newsroom employee, your employee must meet the following conditions:

-

They worked for you for at least 40 weeks during the year you claim the tax credit

-

They work at least 26 hours per week

-

They spend at least 75% of their time producing the news, which includes working on tasks like researching, photographing, writing, and editing

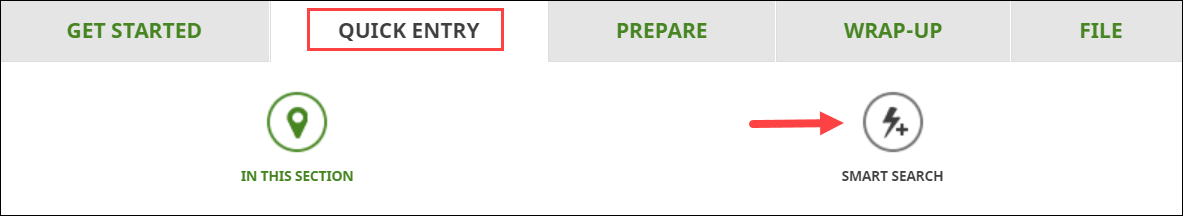

To claim Canadian journalism labour tax credit, follow these steps in H&R Block’s 2021 tax software:

- Type T5013 in the search field and either click the highlighted selection or press Enter to con-tinue.

- When you arrive at the T5013 page, enter the amount from box 236 into the tax software.