Amount for a child under 18 enrolled in post-secondary studies

Revenu Québec offers a tax credit for parents with children under 18 who are post-secondary full-time students. This tax credit reduces your tax payable if you had a dependant child who meets both these conditions:

- Your child was under 18 throughout that year

- Your child was a full-time student pursuing vocational training or post-secondary studies

You can claim $3,166.45 for each completed term that the child began in 2021, up to a maximum of two terms per child. The amount that you can claim is shown on the Relevé 8 (RL-8) slip issued to your child by the school he or she attended.

Note: If your child went to a school outside of Québec, contact Revenu Québec to request a blank RL-8 slip. You can ask the registrar of that school complete the slip.

Remember, for the purposes of this tax credit, your child's income is calculated without taking into account any income during the year that was from scholarships, bursaries, fellowships, or prizes, or from the deduction for residents of designated remote areas.

Generally, you can still claim the amount for a child under 18 enrolled in post-secondary studies if your child has a spouse on December 31. However, you won’t be able to claim this amount if your child is transferring credits to his or her spouse to be claimed on their return.

If you and another person (such as your spouse) financially supported your child, you can split the credit amount in any way you like, as long as it doesn’t exceed the maximum claimable.

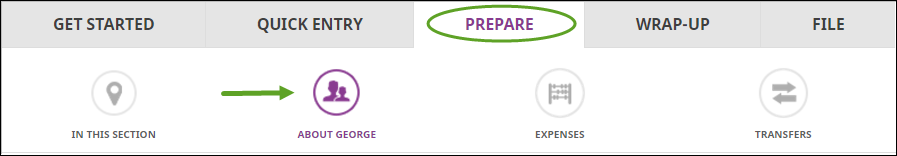

H&R Block’s tax software automatically claims this amount on your return if you have a dependant child (who is under 18 and received an RL-8 slip) and you’ve completed their return. You’ll need to enter your dependant’s RL-8 slip amount and other tuition amounts on the Tuition, education, and textbook amounts page under the About {dependant name} icon.

If you’re preparing your return together with your spouse or common-law partner, the software applies the tax credit to the spouse with the higher income. You can choose to have the lower income spouse claim this amount on the Dependant amounts page under the OPTIMIZATION icon on the Wrap-Up tab.