RC62: Universal Child Care Benefit (UCCB)

Important: The Universal Child Care Benefit (UCCB) was replaced with the Canada Child Benefit (CCB) effective July 2016.

If you were eligible for the UCCB for the months (or years) before July 1, 2016, and you applied for the benefit, the Canada Revenue Agency (CRA) will make a lump-sum UCCB payment to you. You’ll need to report any UCCB lump-sum payment you received in 2021 for previous years, on your 2021 return. You can find this amount in box 10 of your RC62 slip.

Tax Tip: Because the UCCB is a taxable benefit (must be reported as income), it must be claimed by the spouse or partner with the lower net income.

If you made a repayment of benefits for previous years, this amount is shown on box 12 of your RC62 slip. The spouse who reported UCCB income in the previous year must also be the one to claim the repayment of benefits.

Yes. If you indicated that your marital status in 2021 was single, separated, divorced, or widowed, you might want to consider transferring this amount to the child you’re claiming as an eligible dependant so that the benefit amount will be taxed at a lower rate than your own.

For example, let’s say that you received $1,200 from the UCCB and your personal tax rate is 20.5%. Your tax liability for this amount will be $246 ($1,200 x 20.5% = $246). If you transferred this amount to your eligible dependant, the tax liability on this amount would be $180 because it’s being taxed at your child’s lower tax rate of 15% ($1,200 x 15% = $180). A difference of $66 might not sound like much, but it’s money that will stay in your pocket.

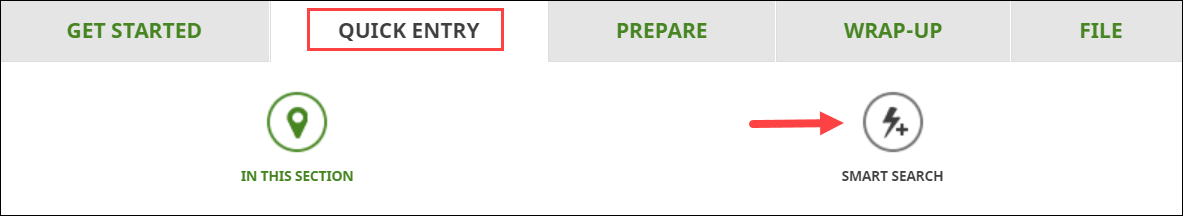

Follow these steps in H&R Block’s 2021 tax software:

- Type RC62 in the search field and either click the highlighted selection or press Enter to continue.

- When you arrive at the page for your Universal child care benefit statement, enter your information into the tax software.