Relevé 8: Amount for post-secondary studies (RL-8)

If you were a full-time student in Québec at some point in 2021, you’ll receive a Relevé 8 (RL-8) slip from your college or university. This slip shows the total amount you paid for full-time post-secondary studies or occupational training, as well as any donations you made to your school.

Note: The following fees and expenses are not included on the RL-8 slip:

- student association fees

- expenses for medical services

- meal and lodging expenses

- transportation expenses and parking fees

As a student, you can use the amount reported in box B of your RL-8 slip to claim a tax credit for tuition or examination fees on your Québec return. Remember, you can only claim this tax credit if the amount reported in box B is more than $100.

Yes. If you’re the parent of a child that’s enrolled in post-secondary studies, you can use the amount reported in box A of your child’s RL-8 slip to claim the amount for a child enrolled in post-secondary studies. Make sure that your child indicates on his or her tax return which parent will be claiming this amount.

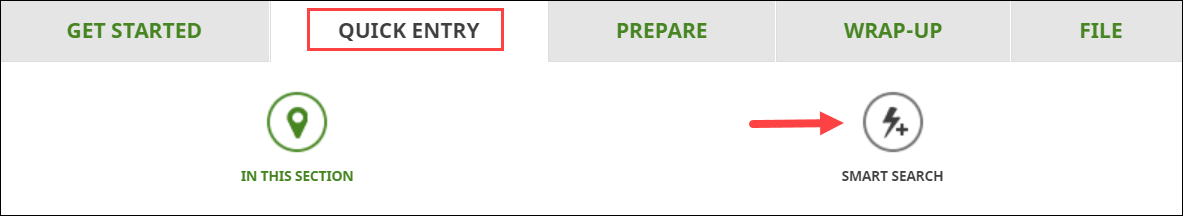

Follow these steps in H&R Block’s 2021 tax software:

- Type RL-8 or relevé 8 in the search field and either click the highlighted selection or press Enter to continue.

- When you arrive at the page for your RL-8, enter your information into the tax software.