Your unused federal tuition, education, and textbook amounts from previous years

If you were a student in a previous year, you might have carried forward your unused federal tuition, education, and textbook amounts. You can claim these unused amounts on your 2021 return to reduce your tax payable.

To find your unused tuition amounts from prior years:

- Refer to your most recent notice of assessment (NOA) or notice or reassessment or

- Log into the CRA My Account service (registration required)

Remember:

- You must claim your carry forward amounts in the first year that you have to pay income tax

- You can’t carry forward unused amounts that you transferred to a parent, grandparent, spouse, or common-law partner and

- Amounts that have been carried forward from a previous year cannot be transferred to a family member

Tax Tip: Even if you don’t have to pay income tax and you want to carry forward all or part of your tuition tax credit this year, you should still file your tax return on time so that the CRA can update their records with your unused credit amount.

Follow these steps in H&R Block’s 2021 tax software to claim your unused tuition amounts from previous years. If you were a student in 2021 and you're not claiming all or a portion of your tuition tax credit, H&R Block’s tax software will automatically carry forward any of your unused tuition amounts for you. You’ll be able to see the carried forward amount on Schedule 11 of your completed return.

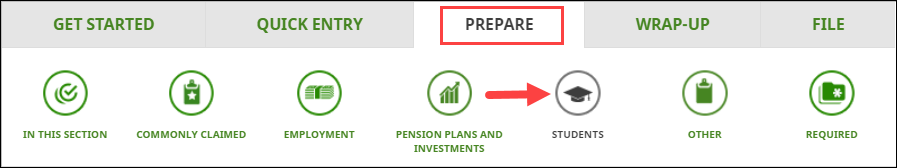

- On the PREPARE tab, click the IN THIS SECTION icon.

-

In the Unused tuition amounts and student loans box, click the Add This Topic button.

- Click the STUDENTS icon. You’ll find yourself here:

- Under the CREDIT AMOUNTS heading, select the checkbox labelled Unused tuition, education, and textbook amounts, and Canada training credit (Schedule 11) and click Continue. If you’re a Québec resident, select Tuition or examination fees carried forward from a previous year (Schedule 11 & Schedule T) and click Continue.

- When you arrive at the selected page, enter your information into the tax software.