Student loan interest paid in 2021 or interest not claimed in a previous year

You can claim the interest you paid on your student loans to lower your income tax payable. However, you can only claim the interest you paid in 2021 (and any of the preceding 5 years, if not claimed already) if the loan was issued to you under:

- The Canada Student Loans Act

- The Canada Student Financial Assistance Act

- Act respecting financial assistance for education expenses (residents of Québec)

- The Canada Apprentice Loan Act

- A similar provincial or territorial government law or

- A law of a province other than Québec governing the granting of financial assistance to post-secondary students (residents of Québec)

Keep in mind, you cannot transfer these amounts to anyone else. Only you can claim the eligible interest amounts that you, or someone related to you, paid on your student loan. If you aren’t up to date in the repayment of your student loans, you can’t claim the interest you paid.

If you don’t need to claim all of your student loan interest amount to reduce your tax payable, any unused amounts can be carried forward for 5 years.

Interest paid on a personal loan or line of credit, a student loan that's been combined with another loan*, or a student loan received from another country doesn't qualify for this credit.

*If you chose to consolidate your student and personal loans with a bank or other financial institution, the interest paid on the new loan doesn’t qualify for this credit.

If you’re eligible to claim the federal amount for your student loan interest, you’re also entitled to a corresponding provincial tax credit, which might vary in amount depending on which province or territory you live in:

- Alberta

- British Columbia

- Manitoba

- New Brunswick

- Newfoundland and Labrador

- Northwest Territories

- Nova Scotia

- Nunavut

- Ontario

- Prince Edward Island

- Québec

- Saskatchewan

- Yukon

Notes:

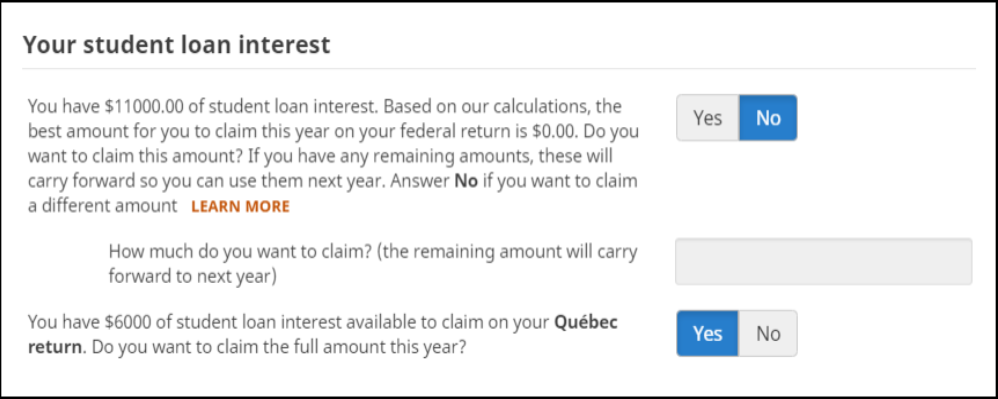

- H&R Block’s tax software will automatically calculate your provincial tax credit based on the amounts you enter on the Interest paid on a student loan page under the STUDENTS icon on the PREPARE tab and the amount you want to claim under the OPTIMIZATION section.

- If you’re a resident of Québec, you no longer need to complete a Schedule M page to claim your provincial tax credit – both the federal and Québec forms are combined in H&R Block’s tax software. You can add your federal and provincial interest amounts and enter the combined total in the relevant field on the Interest paid on a student loan page under the STUDENTS icon on the PREPARE tab. You can also enter your unused student loan interest amounts paid between 2001 and 2020.

- You can add your federal and provincial interest amounts and enter the combined total in the relevant field on the Interest paid on a student loan page.

Since this tax credit is non-refundable (only reduces your tax payable), if you don’t owe taxes in the year but you paid interest on your student loans, it would be more beneficial for you to not claim the interest amount on your return. We suggest you enter the amount in your return, so that you can easily keep track of the amount paid and carry it forward. You can claim this amount on a return for any of the next 5 years to lower your tax payable then. Here’s how.

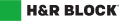

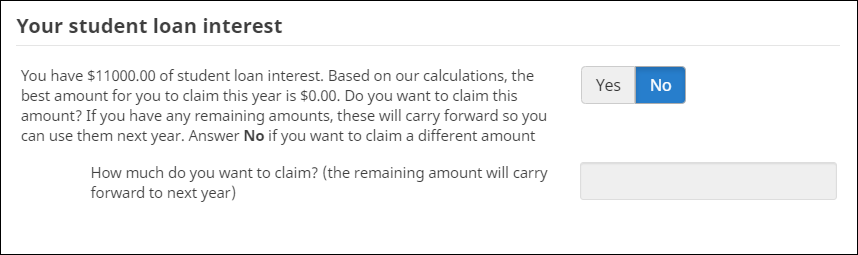

For example: If you don’t owe tax this year, enter all your interest on the Interest paid on a student loan page in H&R Block’s tax software. Then, you can choose not to claim this amount later in your return. Simply enter 0 in the relevant field under the Your student loan interest section on the Your 2021 income page. This page can be found under the OPTIMIZATION icon on the Wrap-Up tab.

If you claim an amount less than the full student loan interest amount, the remainder (your unused student loan interest amount) will be carried forward for you to use in a future year.

For example: let’s say that between 2016 and 2020, you paid $5,000 in interest on your student loans. During that time, you claimed just $1,000 of the total interest you paid on your tax returns. In 2021, you’d be able to claim the remaining $4,000 in interest ($5,000 - $1,000) on your return.

If you paid student loan interest in the past 5 years but didn’t claim the full amount or claimed an amount less than the full amount, you will have an unused student loan interest amount. Refer to your most recent notice of assessment (NOA) issued to you by the Canada Revenue Agency (CRA), or go to your CRA My Account to see your unused amounts and claim them on your tax return for the year.

You’ll enter your unclaimed amounts of student loan interest on the Interest paid on a student loan page in H&R Block’s 2021 tax software.

Note: You can carry forward your unused student loan interest for only 5 years. For example, on your 2021 return, you can enter your unclaimed amounts from 2016 to 2020.

Since this tax credit is non-refundable (only reduces your tax payable), if you don’t owe taxes in the year but you paid interest on your student loans, it would be more beneficial for you to not claim the interest amount on your return. We suggest you enter the amount in your return, so that you can easily keep track of the amount paid and carry it forward. You can claim this amount on a return for any of the next 5 years to lower your tax payable then. Here’s how.

For example: If you don’t owe tax this year, you should still enter all your interest on the Interest paid on a student loan page in H&R Block’s tax software. However, you can choose not to claim this amount later in your return. Simply, enter 0 in the relevant field under the Your student loan interest section on the Your 2021 income page. This page can be found under the OPTIMIZATION icon on the Wrap-Up tab.

As a Québec resident, you can also choose to claim a different amount for your federal tax credit and your provincial tax credit. If you claim an amount less than the full student loan interest amount, the remainder (your unused student loan interest amount) will be carried forward for you to use in a future year.

Note: You can only carry forward amounts that you have not claimed federally or on your Québec return.

If you paid student loan interest between 2001 and 2020 but didn’t claim the full amount or claimed an amount less than the full amount, you will have an unused student loan interest amount.

You can refer to line 62 of your Schedule M from last year or your most recent notice of assessment (NOA)/notice of reassessment to determine the amount of unused student loan interest amount you can claim.

If you paid interest on your student loans after 1998 but didn’t calculate your carry forward amounts last year, you’ll need to enter the result of the following calculation into H&R Block’s tax software:

Interest you paid between 1998 and 2020 minus the interest you’ve already used to claim this credit in the past

For example: let’s say that between 1998 and 2020, you paid $2,400 in interest on your student loans. During that time, you claimed just $2,100 of the total interest you paid on your tax returns. In 2021, you’d be able to claim the remaining $300 in interest ($2,400 - $2,100) on your return.

Follow these steps in H&R Block’s 2021 tax software:

Important: Enter all the interest you paid on this form (federal and provincial, combined). You’ll choose how much you want to claim on the Wrap-Up tab, in the OPTIMIZATION section of your return.

- Under the PREPARE tab, click the IN THIS SECTION icon.

- In the Unused tuition amounts and student loans box, click the Add This Topic button.

- Click the STUDENTS icon. You'll find yourself here:

- Under the CREDIT AMOUNTS heading, select the checkbox labelled Student loan interest paid in 2021 or interest not claimed in a previous year, then click Continue.

- When you arrive at the Interest paid on a student loan page, enter your information into the tax software.

Note: When entering the interest amount you paid for the current year, you can add your federal and provincial interest amounts and enter the combined total in the field labelled, How much interest did you pay on your student loan in 2021?.