Claiming your tuition fees with your T2202 certificate

Important: The T2202A certificate has been replaced by the new T2202 certificate for tax year 2019 and onwards. In addition to this, The federal tax credit for textbook amounts was eliminated in January 2017 for further tax years (2016 is the last tax year it could be claimed). Once you have filled out your T2202 form, any provincial/territorial tax credits for textbook amounts will be calculated on your provincial schedule 11 form (not all provinces and territories provide a credit for textbooks).

The T2202 is issued by Canadian colleges, universities, or other educational institutions certifying that a student was enrolled in a program that qualifies for the federal tuition tax credit. If you’re a student who was enrolled during the year in a qualifying educational program at a Canadian college or university, you would’ve received a T2202.

The T2202 lists the total eligible tuition fees you paid, as well as the months you were enrolled in school either part-time or full-time in the tax year. You can use this information to:

- Claim your tuition tax credit

- Transfer any unused tuition tax credit amount or

- Carry forward unused tuition tax credit amounts to a future year

You can claim the tuition tax credit if you received the T2202 certificate (or another tax certificate like the TL11A) from your school and if the eligible tuition fees you paid was more than $100. Information on the T2202 certificate is used to complete the federal and provincial Schedule 11 forms (or Schedule T, if you’re a Québec resident) to calculate the tuition tax credit. Fortunately, H&R Block’s tax software automatically completes these forms for you based on the information you enter on the T2202 page in the software.

Note: You can’t claim the tuition amounts listed on your T2202 if:

- the fees were paid or reimbursed by an employer (to you or your parents) and the amount wasn’t included in the annual income

- the fees were paid by a federal or provincial job training program and the amount wasn’t included in your income

- the fees were paid (or was eligible to be paid) under a federal program to help athletes and the amount wasn’t included in your income

If you received more than one T2202 certificate, you can claim all amounts that are more than $100. However, if you’re enrolled at various educational institutions as a full-time and a part-time student and if there is an overlap in the month of your enrollment, you can’t claim the amounts twice; claim only one amount for each month, either the full-time amount or the part-time amount.

Note: If you have more than one T2202 with full-time and part-time amounts, H&R Block’s tax software will automatically claim your full-time amounts first (up to 12 months) and then for any remaining months, claim your part-time amount.

You have to claim your 2021 tuition fees on your tax return first. If, however, you don’t need all or part of your tuition tax credit to reduce your taxes, you can:

- Transfer a maximum of $5,000 of your 2021 federal tuition amount to your spouse or common-law partner, parent or grandparent, or your spouse’s parent or grandparent. You can also transfer the applicable maximum of your provincial and territorial tuition amounts. Refer to the CRA website for more information on how much of your provincial tuition amounts you can transfer.

Use the back of your T2202 certificate to designate the transfer amount to your family member. Be sure to give him or her a copy of the transfer section.

Note: You can’t transfer your unused 2021 tuition amounts to your parent or grandparent, or your spouse's parent or grandparent, if your spouse is claiming the spouse or common-law partner amount or amounts transferred from your spouse or common-law partner on their tax return.

- Carryforward the unused tuition amount for use in a future year. You’ll need to claim this amount in the first year that you have to pay income tax. If you have carried forward your unused tuition amounts from previous years, you can’t transfer this amount to anyone else.

If you want to claim your unused tuition amount that you carried forward to 2021 from a previous year, you can do so on the Tuition, education, and textbook amounts carried forward from a previous year page under the STUDENTS icon. For more information, refer to our help centre article: Your unused federal tuition, education, and textbook amounts from previous years.

- Eligible tuition fees can include:

- Admission fees

- Academic fees

- Charges to use library or laboratory facilities

- Exemption fees

- Examination fees that are integral to a program of study

- Application fees (but only if you enrolled in the institution)

- Confirmation fees

- Fees to obtain a certificate, diploma or degree

- Membership or seminar fees that are related to an academic program and its administration

- Mandatory computer service fees

If you’re a student enrolled in a post-secondary program at an educational institute in Québec, in addition to the T2202, you’ll also receive an RL-8: Amount for post-secondary studies slip. You can use the information on your RL-8 slip to claim the Québec tuition tax credit, as well as to transfer tuition amounts to your parents.

Follow these steps to enter your T2202 slip in H&R Block’s 2021 tax software:

Important: Effective 2017, the federal education and textbook tax credits have been eliminated. If you’ve got unused education and textbook credits from years prior to 2017, you’ll still be able to claim them or carry forward these amounts for use on future returns. Depending on your province or territory of residence you might still be able to claim your provincial education and textbook amounts. H&R Block’s tax software will automatically claim these provincial amounts for you (if applicable), based on the information you enter on the T2202 page.

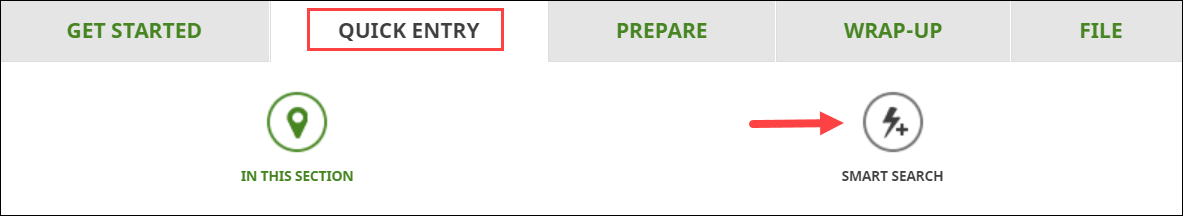

- Type T2202 in the search field and either click the highlighted selection or press Enter to continue.

- When you arrive at the page for the T2202, enter your information into the tax software.

Note: If you paid examination fees in 2021, enter the amount in box 26 of a new T2202 and leave the other boxes blank.